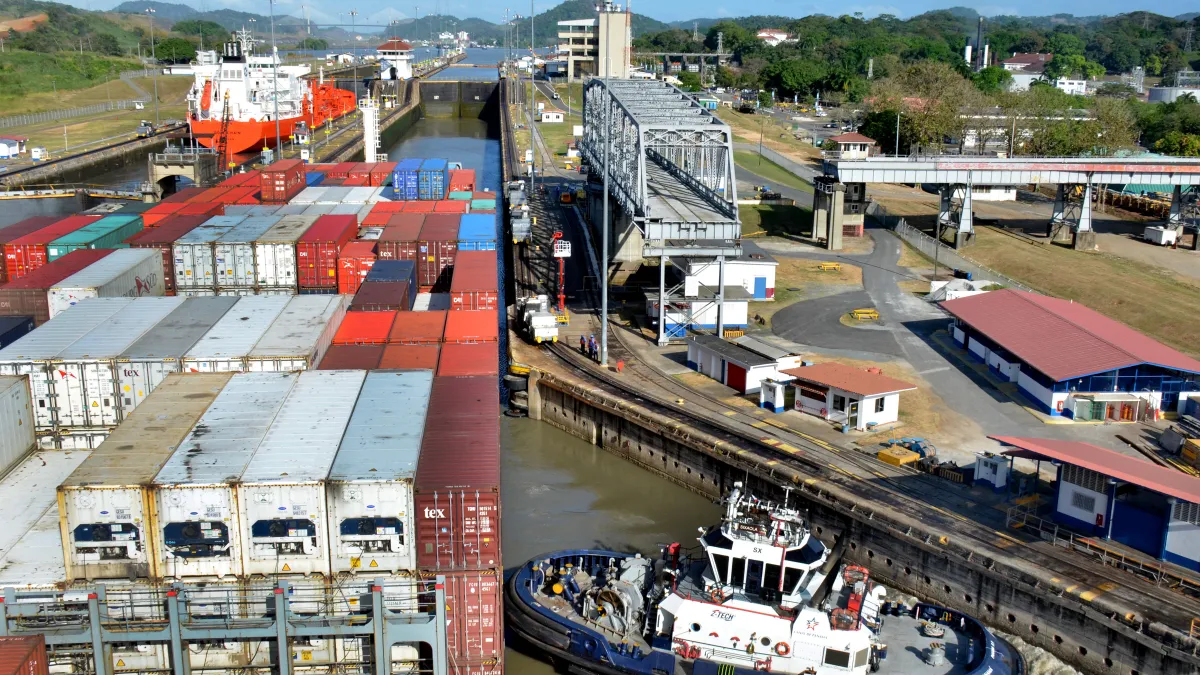

The Panama Canal announced another set of restrictions to reduce transit capacity as a result of continued low-water level at Gatún Lake.

The number of vessels allowed to move through the canal each day was lowered from 32 to 25 on Nov. 3. Daily ship crossings will further decrease every month until next February, when the limit reaches 18.

| Dates | Number of reservation slots |

|---|---|

| November 3 to 7 | 25 |

| November 8 to 30 | 24 |

| December 1 to 31 | 22 |

| January 1 to January 31, 2024 | 20 |

| As of February 1, 2024 | 18 |

SOURCE: Panama Canal

The restrictions mark a significant escalation from earlier this summer, where June averaged 33 vessel arrivals per day, with a high of 49 vessels that month, according to the canal’s operations summary. Water levels at Gatún Lake, which feeds the canal, have reached “unprecedented levels for this time of year,” according to the Panama Canal Authority. Rainfall in October was the lowest on record since 1950, and the country is set to enter a seasonal dry period.

Since the shipping channel began to pose draft restrictions in July, shippers have had to look for alternative routes and leverage freight diversions to move their cargo. Trade between China, Japan, South Korea, and certain regions of the U.S. continue to be impacted as 46% of container movement from northeastern Asia to the U.S. is facilitated by the canal.

The canal is also an important gateway for the agriculture industry and restrictions come as the grain export season begins in earnest. The U.S. exported over 26% of soybeans and 17% of corn through the Panama Canal in 2022, primarily to markets in Asia, according to Rabobank. China has looked to import more grains from countries including the U.S. to offset a harvest headwinds from severe weather.

Capacity from Asia to the U.S. has decreased about 2% to 10% per week as carriers adjust to the weight restrictions, with lighter containers taking priority, said C.H. Robinson VP of global ocean services Matthew Burgess. The new restrictions are still being analyzed and it could cause delays of up to two to three days for vessels and containers.

Reduced capacity in the canal could push agriculture shippers to the Suez Canal, according to the USDA’s grain transportation report. However, that could bring its own set of risks with the prospect of a widened conflict in the Middle East.